WeChat parent Tencent invested in JD.com to build out its commerce capabilities. Others lead users to their shop on e-commerce platform JD.com, Alibaba's main challenger in the e-commerce space in China. Many major brands don't sell directly on WeChat, but use it to smoothly guide people onto their own online shopping platform, as Amazon and H&M do. Knorr expanded its WeChat followers 25% to over 1 million a quarter of chefs who saw the campaign video on WeChat reposted it, and sales rose 21%. Knorr, a b-to-b brand in China, aimed its message at chefs who had to work through the festivities, and the campaign let chefs share recipes and greetings in their local dialects. Isobar experimented with precision targeting in a campaign for Unilever's Knorr during Chinese New Year.

She believes it has interesting potential for driving purchases with existing customers, and for mining its big data for hypertargeting. Lin-Baden argues that brands shouldn't try to use WeChat to get reach. "It's a private lunch, it's a VIP room, it's a community for club members." WeChat, on the other hand, "is not designed as a walk-in store," she said. Jane Lin-Baden, Asia-Pacific CEO of Isobar, compares Alibaba platform Tmall to a shopping center in a busy area, where people window-shop for something new. It's generally a place where users connect with people and brands they already know. If WeChat doesn't always seem like a natural place to shop, that's partly because WeChat has proceeded carefully with monetization, limiting how brands can reach out to people and cracking down on super-viral marketing tactics.

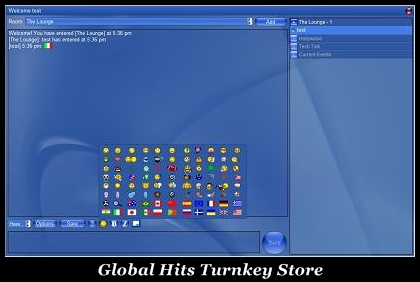

#VCHAT FLASH MOVIE#

She uses WeChat's wallet to pay for small-ticket items like takeout, movie tickets and her phone bill the only other purchases she could recall there were a magazine and a phone cover bearing quotations from former president Jiang Zemin. People tend to use Alibaba's payment service, Alipay, for bigger purchases.Ĭhen Yiting, a 21-year-old studying communications, said she prefers shopping on Alibaba's eBay-like platform Taobao. WeChat still plays a small role in e-commerce in China compared to Alibaba Group, whose annual shopping festival just moved $17.8 billion in merchandise in 24 hours. "People buy everything on WeChat-but usually, they don't spend big money," said Alexis Bonhomme, general manager and co-founder of Curiosit圜hina, a company focused on social customer relationship management and Chinese digital platforms.

If WeChat shopping has exciting potential, there's also room for growth. In a report in April, McKinsey said about 31% of users initiated purchases on WeChat, twice as many as a year ago. Increasingly, it's also a place where retailers, brands and ordinary people sell things online, either inside WeChat or by moving people seamlessly to outside shopping platforms. It also has an integrated payment system, and people use it to book taxis, order takeout, settle electric bills and pay the cashier at shops from KFC to the Gap. It blends aspects of Facebook, WhatsApp and Instagram. It has transformed China's digital habits the average user there spends 70 minutes a day on the app, according to a report by KPCB analyst Mary Meeker. WeChat, launched by internet giant Tencent in 2011, now has 806 million monthly active users. A lot of it feels like a test to see what works. To drive sales, brands are trying ads, coupons, flash sales and games sent out to their WeChat followers-all with the hope people will share them with friends. WeChat, the mobile app that Silicon Valley scrutinizes for what the future might hold, hosts many experiments in social shopping. Even Dior has used WeChat to push sales: In August, it hosted a WeChat flash sale for a customizable limited-edition powder-pink Dior handbag selling for $4,130. H&M sent its followers a pinball-like mobile game to win discounts once finished, the game deposited players inside the brand's e-store.

To drum up interest in its products imported from the U.S., Amazon just put a video ad on WeChat, the all-purpose mobile app, with a link guiding people to its online shop. Amazon is a minor player in China, with about 1% of the local e-commerce market.

0 kommentar(er)

0 kommentar(er)